|

REVIEW: A Preliminary Investigation of Energy Return on Energy Investment for Global Oil and Gas Production. This post reviews a paper by Nate Gagnon, Charles Hall and Lysle Brinker titled: âo[ogonek]A Preliminary Investigation of Energy Return on Energy Investment for Global Oil and Gas Production,âo[caron] published recently in the peer-reviewed journal Energies. The lead author was my colleague for two years at SUNY-ESF and the second author is currently my Ph.D. advisor and has published numerous guest posts here on The Oil Drum. See here for a list of previous posts relating to work by Dr. Charles Hall, and here to download a full-text PDF of this paper. EROI of Global Oil and Gas Production

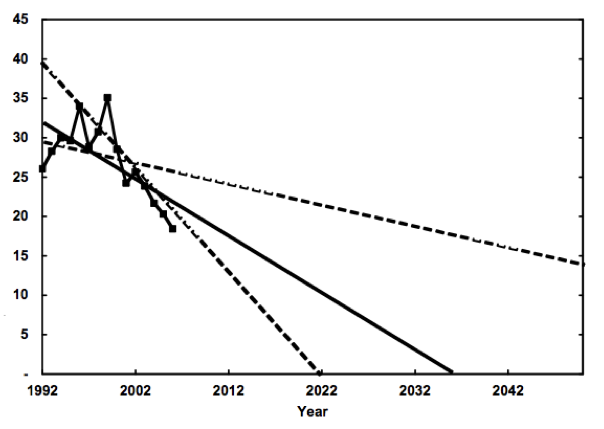

As the title of this article indicates, the authors estimate the energy return on investment (EROI) for global oil and gas âo[ogonek]production.âo[caron] The first thing to note is that the calculation is actually for the EROI of global exploration, development, and production (commonly called E+P or âo[ogonek]upstreamâo[caron]) âo[base "] a much more comprehensive estimate than just production. They estimate that the EROI of global oil and gas E+P in 2006 was roughly 18:1 (above figure). To establish these estimates the authors rely on three datasets: a) the Energy and Information Administration (EIA), and b) the British equivalent of the EIA, and 3) John S. Herold, Inc., a privately managed database consisting of data on total "upstream" costs (i.e. all costs up to the point the oil comes out of the ground) of publicly traded energy firms around the world. The crux of their analysis depends on the conversion of money numbers into energy numbers. Since global energy costs are not maintained in energy units, but in economic units only, they derived an energy intensity value for each dollar spent in the energy industry. These numbers, derived independently for the energy industries within the U.S. and England, were about the same: roughly 20 MJ per dollar for both countries in 2005. The energy intensity numbers were multiplied by the estimates of money spent to get rough estimates of energy cost of energy production. In addition to estimating the current upstream EROI of global oil and gas, they extrapolated three trends from their time-series estimates of EROI and show global EROI declining to 1:1 between either 2022 or sometime in the very distant future, with the best estimate being about three decades away. To do this, the authors forecast linearly the historic trend of global EROI, which is, as the authors acknowledge, a forecasting methodology fraught with problems. Nonetheless, the forecasts provide a thought-provoking view of what may happen if society continues along a "business as usual" path. Linear extrapolations of historic EROI trends  The authors also attempt to answer the question âo[ogonek]What are the reasons for the decline in EROI estimates, especially since 1999?âo[caron] They offer two solutions: 1) technology is seemingly being outpaced by depletion, and/or 2) increasing the annual drilling rate decreases the drilling efficiency. The drilling intensity decreased during the early and mid 1990s when EROI was actually increasing, but has increased since 1999. This has led to a sharp decrease in drilling efficiency (barrels found/produced per well drilled). Their best guess is that both options are operational, a contention with which I am inclined to agree. Improved technology is increasingly used in E+P activities, including, of course, drilling. So the fact that the EROI of E+P has declined over the past 10 years indicates that easier-to-access resources, i.e. high EROI resources, are increasingly rare (if found at all), because even with increasing technology and drilling efforts, we are witnessing declining EROI. Lastly, the authors address the major assumptions they have made while performing their analysis. This is a crucial step in most large numerical analyses and, unfortunately, one that is often overlooked. The assumptions are: 1) âo[ogonek]changes in monetary expenditures indicate changes in energy expenditures.âo[caron] The second assumption is the most problematic from a scientific perspective because upstream costs vary widely from deep offshore, to tar sands, to shallow offshore, to onshore drilling. The application of energy intensity numbers, which are derived directly from cost data, from one area of the world to the rest of the world is potentially flawed. But in reality, this is a reflection of one of the conclusions the authors derive from their work, i.e. WE NEED MORE/BETTER DATA. The fact of the matter is that although the authors had access to three extensive data sets, two public and one private, they were still able to access data for only 40% of the worldâo[dot accent]s oil production. Furthermore, many of the data sets that are unavailable to public scrutiny are the most important, i.e. that from Saudi Arabia, Russia, Iran, and every other Nationalized Oil Company. Some interesting quotes from the manuscript:

[The Oil Drum: Net Energy - Discussions about Energy and Our Future] 4:02:39 PM |

|

CPRS in Crikey. I have written a ‘Clarifier’ for Crikey today on the CPRS. It is reproduced over the fold. <a style="display:none;" id="ddetlink117850614" href="javascript:expand(document.getElementById('ddet117850614'))">Read the article <script>expand(document.getElementById('ddet117850614'));expand(document.getElementById('ddetlink117850614'))</script>

[Core Economics]Crikey Clarifier: CPRS Schemes Joshua Gans, Crikey, 12th August 2009. What is a “cap and trade” plan? Both the Government and Malcolm Turnbull are putting forward “cap and trade” plans to ensure that Australia plays its part in reducing global greenhouse gas emissions. Such emissions are the quintessential example of what economists call “externalities” whereby the private actions people take (in this case, consumption and production in general) have consequences that are more widely felt (in this case, pollution). We have too much pollution because we treat it as something we can do for free, so economists argue that it needs to be priced. One way to achieve this would be to price it directly. That is, decide what harm each unit of emissions is doing in monetary terms and tax the emitter accordingly. This carbon tax is direct but has the disadvantage that you have to work out the price. That is the hard part as science tells us what level of emissions to target and economists can only guess at the price that will achieve that target. Instead, thinking in market-terms, economists suggested rationing the emissions directly. So instead of having the Government set the price of emissions, we can let the market do it. To achieve this, the Government has to issue [base ']Äòpermits[base ']Äô to emit. In the olden days, this raised the ire of environmentalists because it looked like we were giving permission to pollution; a form of approval. Of course, they were right but if done right, it was permission to pollute in aggregate no more than the environment could bear. The big advantage of emissions permits is that we can get lots wrong and still do good so long as we get the big target right. For instance, we can give permits to the wrong people who don[base ']Äôt actually want to pollute and they can sell them in the market to those who do. The permits shuffle around like deck chairs but so long as there aren[base ']Äôt too many deck chairs, the boat won[base ']Äôt sink. Of course, it is better to have a permit given to you with the option of using it or selling it than to have no permit at all. So Governments have to work out how to allocate permits. Economists like an auction model so that the Government effectively starts by giving the permits to itself and selling them. That allows the proceeds to be distributed by other means. But alternatively, Governments can cut to the chase and distribute the permits by those other means. What are the main differences between Turnbull and Government[base ']Äôs plan? The main differences between the Government[base ']Äôs plan and that proposed by Malcolm Turnbull have to do with how the permits are allocated. The Government wants to auction them all off except to “trade-exposed, emissions-intensive” industries who will get an allocation freely and be given incentives to use rather than sell them. Malcolm Turnbull would prefer to auction fewer permits off and give both trade exposed and the electricity generators free permits. The goal of having free permits is to shield those industries from big market consequences (that is, higher costs that have to be passed through to consumers) and at the same time soften the impact of the introduction of the policy. Of course, with regard to electricity generators, the Government is concerned about the impact too but instead of coming up with a way to stop those higher costs being passed through to consumers, it prefers to compensate the generators directly using the “other means” discretion that comes from a larger pool of permit auction revenues. But there is an important difference between the two. In Malcolm Turnbull[base ']Äôs plan price signals on energy come in gradually rather than a big bang. Frontier Economics, who prepared the case for this plan, argue, and this is consistent with Treasury modelling, that electricity demand does not change in the short-run but after that it can change as people buy energy efficient equipment. So, as a matter of economics, it is tomorrow[base ']Äôs electricity price signal that matters and not today[base ']Äôs. Hitting people today is like some sort of tax with short-run economic costs. There are several reasons to be doubtful about this logic, however. First, if short-run demand is truly insensitive to price, then a hike in prices hits household budgets but presumably that is what the compensation to households was supposed to cover. So we can either not have the hike and forego permit auction revenues for household compensation or we can have it and compensate households using those revenues. I can[base ']Äôt see where the cost arises. Second, there is much to like about the economic model whereby future price signals drive decisions but there is plenty of reason not to place too much faith in it. Short-run price signals matter and combined with good information they can work to change behaviour now. It isn[base ']Äôt all about durable appliances but how we use electricity at the moment. Shielding users from those signals is likely to be a risk not worth taking. It is better to get prices right and soften the income issues with compensation. That is the standard economic approach. What would be a better way to deal with electricity? Rather than compensation which, whether it be cash or permits, has a tendency to stick, a better way forward is to raise the regulated price cap on electricity to final consumers by some margin, say 20 percent, over the next few years. In return for that, retailers will have to put in smart meters into households. The twin effect of that will get some behavioural changes at the user end. But the short-run effect will be to see more money available in the electricity sector and so a big incentive to move quickly on new investment. And what new investment will that be? Ones that economise on emissions in the long-term. How can Turnbull’s plan promise a deeper cut in emissions if it costs industry less and cuts less jobs? If there is not much extra going on with the electricity plan, where does the big gain in Turnbull[base ']Äôs plan come from? The big factor driving the Coalition[base ']Äôs potential “free lunch” of tighter emissions and lower costs were measures to allow for more trade in international permits.¬[sgl dagger]These are a good thing. In my mind, it is the single biggest reason we need a good, workable and widespread international agreement. But let[base ']Äôs be clear, allowing more of this in the future is not a [base ']Äòmake or break[base ']Äô issue for the Government[base ']Äôs legislation. That legislation can be passed without this and have precisely the same short-term effect. The Coalition can then run on permitting the change later and having a real debate. To knock down the legislation on this issue is a mistake. That said, if the Government wants to allow for more trade contingent on international agreement and this will secure Coalition support, then why not do it? In the end, the Government and Coalition are too close together to have politics block this. Do a deal and let us get on with it. Joshua Gans is an economics professor at Melbourne Business School. He writes on these issues at economics.com.au. 3:00:06 PM |